A simple way to teach kids good money habits.

Family Bank is a simple way to keep track of your kids savings and spending money while encouraging them to save regularly.

Features

Turn everyday allowance moments into a clear, kid-friendly ledger. Family Bank keeps spending, saving, and rewards visible so families can talk about money with confidence.

Accounts that match real life

Everyday, Savings, and Term accounts make goals feel tangible, not abstract.

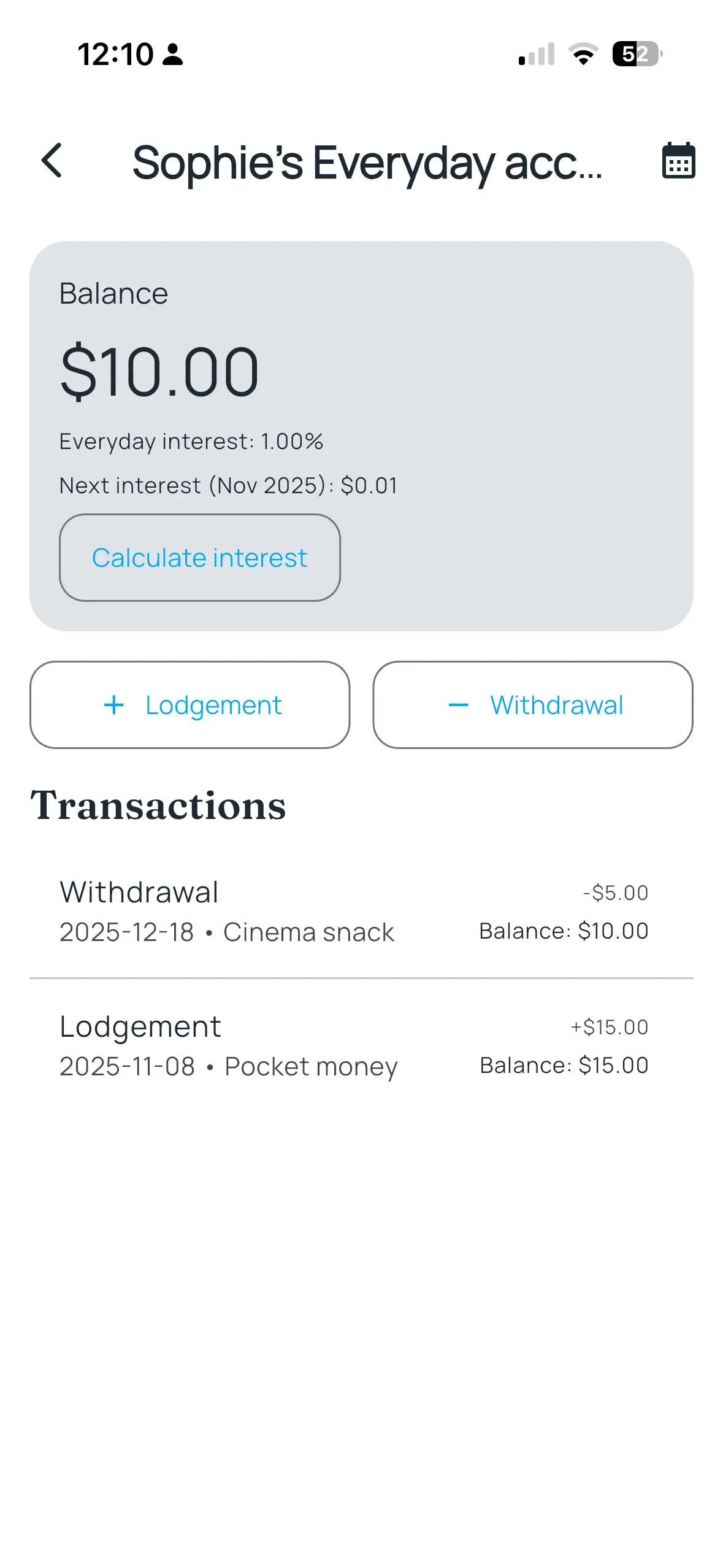

Moments become money lessons

Log lodgements and withdrawals with notes so kids see the “why” behind each number.

Interest you control

Set rates, add a regular-saver bonus, and preview what interest will pay out.

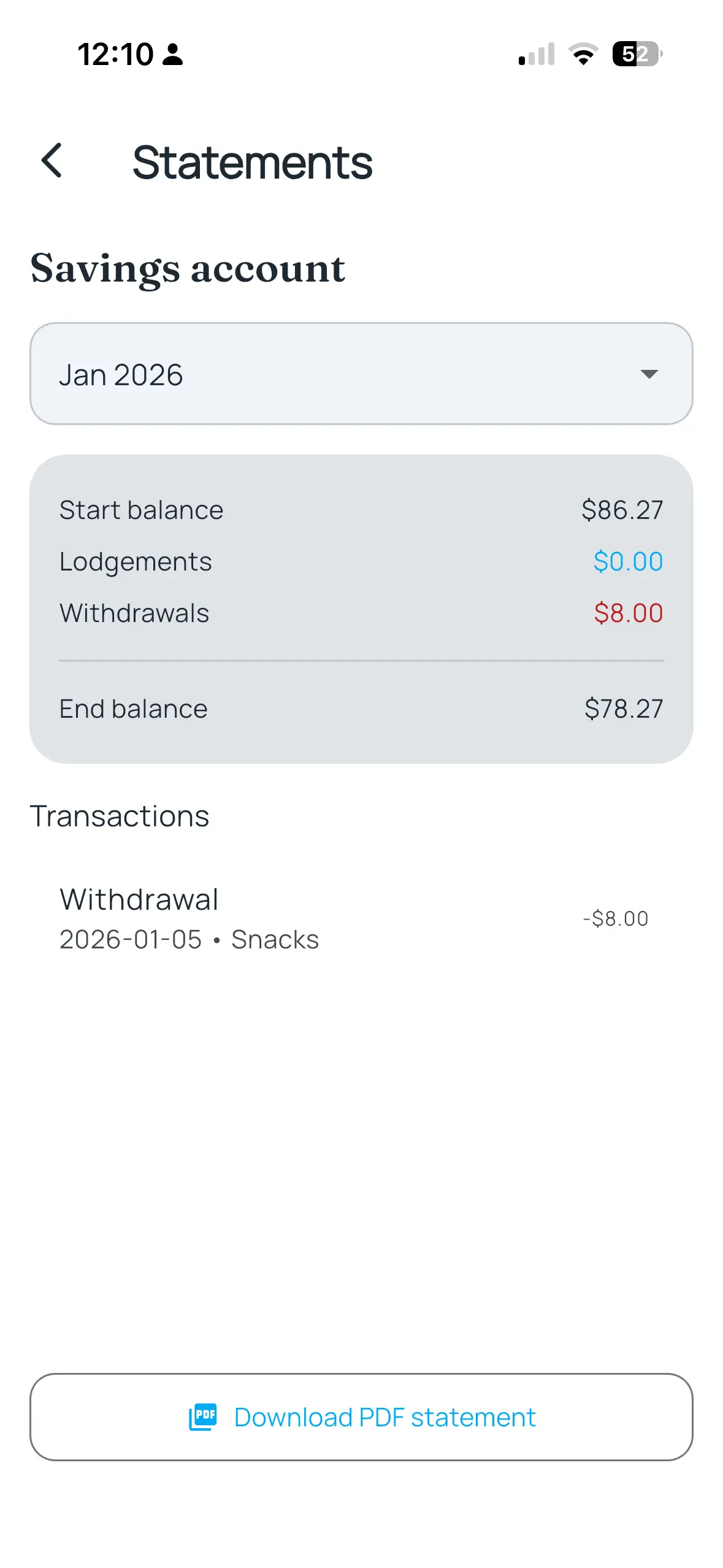

Monthly statements, ready to print

Tap into monthly summaries and export a PDF statement for every account.

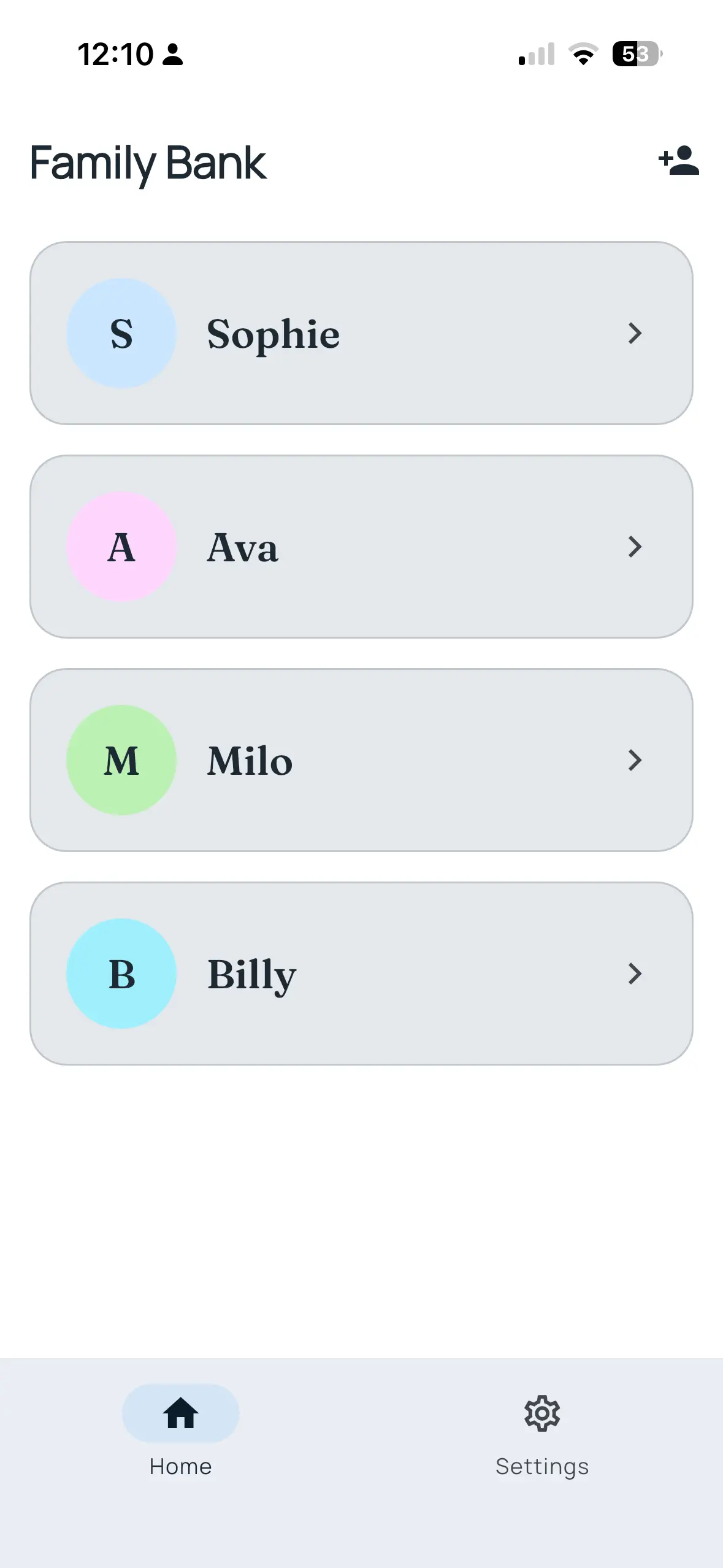

Profiles with personality

Give each child a name, color, and a home screen view that feels like theirs.

How it works

Family Bank mirrors the rhythm of a real bank account, but with training wheels and parent control built in.

Set the family rules

Name your family bank, choose a currency symbol, and set the interest rates you want.

Add each child

Enter the child's name and choose a color to personalise their accounts.

Record savings and spending

Capture allowances, chores, and purchases so kids see the cause and effect Help kids decide when to use their everyday account and when to use their savings account.

Calculate interest together each month

At the end of each month open the interest preview, talk it through, and apply interest with one tap.

Support & Contact

Frequently asked questions

Is this a real bank account?

Family Bank is not a real bank account. As a family we struggled to keep track of our kids money and allowances. We used a physical notebook to track our kids money and allowances however this was not very practical. We found we did not have it with us when we needed it. Family Bank is a learning tool. Balances are virtual and designed to help kids practice money habits before real accounts. It is up to the adult to manage the actual money in real life.

Why did you create Family Bank?

As a family we wanted to encourage our kids to save from a young age. We started by allowing them to earn interest for regular saving. We soon struggled to keep track of our kids savings and allowances. We tried using a physical notebook to keep track however this was not very practical as we did not have it with us when we needed it. Family Bank is our solution, simple way to keep track of our kids savings and spending money.

Do kids need their own login?

No. This app is intented for adults to use as a tool to manage their kids savings. Parents create and manage the family bank. Kids do not have a login.

Can I customize interest and currency?

Yes. Set everyday, savings, and bonus rates plus your preferred currency symbol when you first setup the family bank. You can also update these later in the settings.

How do statements work?

Each account has monthly summaries with opening balance, activity, and interest. You can export a PDF statement to share, print out or save. We find out children enjoy getting a physical printout.

Will my family data sync across devices?

Your data is tied to your account and syncs across devices where you sign in with your email and password.

How do I request account deletion?

Email our support team at support@usefamilybank.com with the subject "Account deletion" and the email you used to sign up. We will be in touch to confirm you are the account holder and then we will delete the account and associated data.

Contact us

If you have any questions, suggestions or need assistance, please don't hesitate to reach out to our support team.